WHAT IS RESPONSIBLE INVESTING?

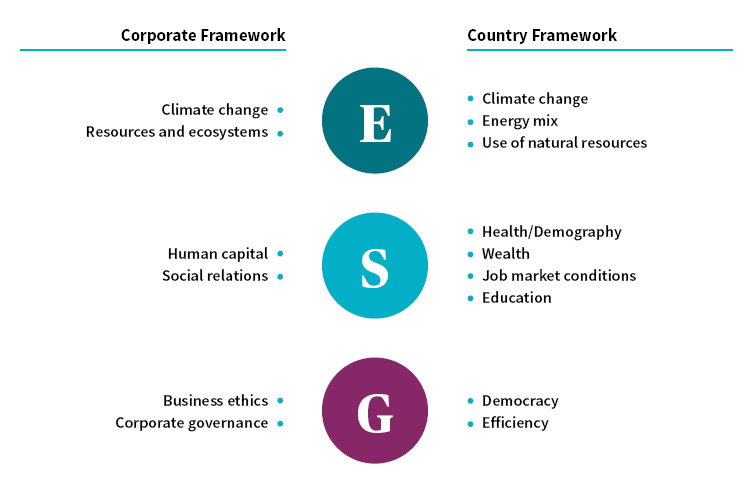

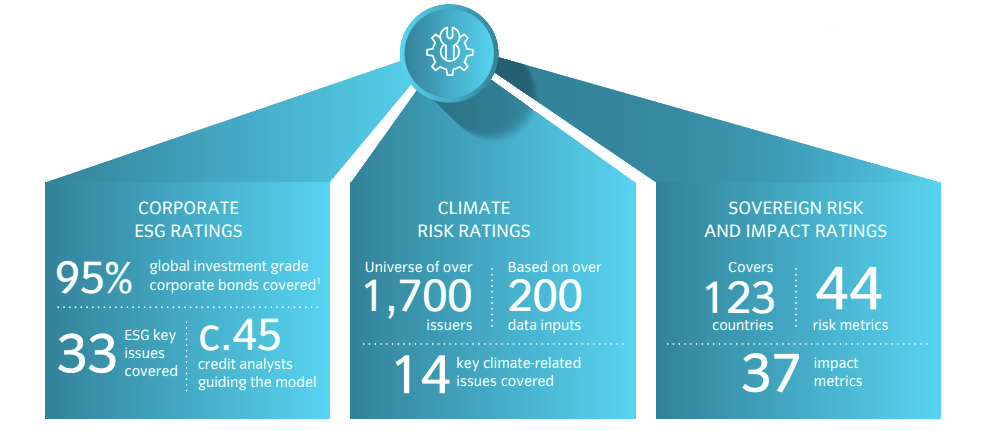

At Winxcapital, we define responsible investing (RI) as an investment process that incorporates environmental, social and governance (ESG) factors into its approach. RI enables clients to align their investments with global megatrends that are changing the investment landscape. Issues such as increasing regulation, the growing need for risk mitigation and a heightened social conscience can be more effectively addressed by integrating ESG factors into the investment process.

WHY IS RESPONSIBLE INVESTING IMPORTANT?

ESG can allow firms to foster a meaningful change in the global economy, and in the communities in which we live and work. We believe that ESG analysis leads to more effective investment solutions that address global challenges and create sustainable value for our clients.

The integration of ESG factors is used to enhance traditional financial analysis by identifying potential risks and opportunities beyond technical valuations, providing data on issues such as potential reputational risk or identifying firms which are adapting to meet new market challenges. It is important to note that the main objective of ESG integration remains financial performance.